[ad_1]

Most Philadelphia property house owners have already paid their 2022 property taxes. If you have not paid your invoice, it is essential to take action by December thirty first. Your account stability will solely enhance if you happen to miss this deadline.

The countdown begins now; you’ve lower than a month to shut the door because of further costs being added to your stability. Paying now can even defend your account from being transferred to a set company or regulation agency.

Should you do not pay by December 31, your account will grow to be delinquent on 1st of January. At this level, town will place a lien in your property and add authorized charges that can enhance the dimensions of your debt.

You’ll be able to beat time:

Paying on-line – you possibly can test your stability and pay your payments on the Philadelphia tax heart. The method is secure, quick and handy. It is usually the easiest way to pay your property tax in Philadelphia. To look and pay:

- Go to tax-services.phila.gov.

- Discover “Search Property” within the “Property” panel. You solely want an tackle or OPA quantity to entry your property on the Philadelphia Tax Heart. Username and password are no required.

- Enter your tackle on the “Seek for property” display and press “Search”. Your property’s OPA quantity will seem in blue on the precise aspect of the identical display. Choose it and go to the following display the place you possibly can see a abstract of your actual property account. From this display, you can even “Make Fee”, “View Interval Steadiness”, “Apply for Actual Property Help Applications”, and “View Lien and Debt”.

One other fast method to pay on-line is by deciding on “Make Fee” within the “Funds” panel on the Philadelphia Tax Heart homepage. Choose ‘Sure’ to pay your invoice for the present yr and enter the letter ID on the prime of your invoice to proceed along with your cost.

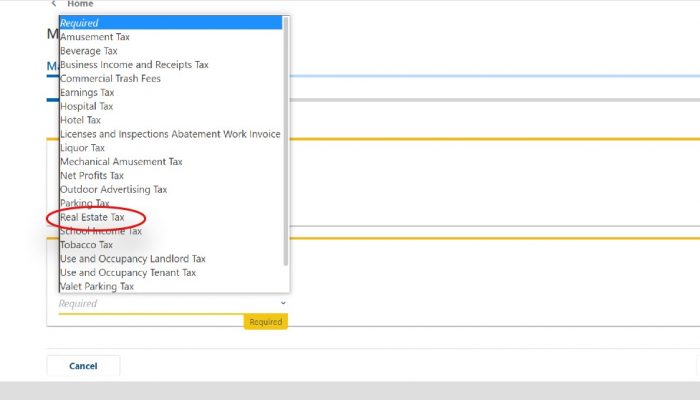

House owners wishing to pay overdue payments ought to choose “No” on this display and use the drop-down menu to pick “Property Tax”. Observe the on-screen directions to finish your cost. Do not forget that paying with an eCheck is at all times freed from processing charges.

When you do not want a username and password to pay on-line, prospects who personal or handle a number of properties do contemplate making a username and password. This manner you possibly can see all of your property balances from one dashboard.

Should you miss a invoice within the mail or it goes lacking, you possibly can simply discover your property tax stability on the Philadelphia Tax Heart. Merely seek for your property utilizing the “Property” panel on the location’s residence web page and comply with the directions to search out your property and repay any pending balances. Once more, username and password should not required.

It’s also possible to pay the invoice:

- By cellphone by calling (877) 309-3710,

- Personallywithin the Municipal Providers Constructing (MSB), reverse the Metropolis Corridor, or

- Through mail by sending cost to:

Philadelphia Treasury Division

submit workplace field 8409

Philadelphia, PA 19101-8409

Assist is offered

Paying your property tax in full and on time is at all times finest, however we perceive that some landlords can not afford to pay all their payments in full. If that is your case, don’t wait and speak to us! The Division of Income provides a number of cost agreements with versatile phrases for householders. It’s also possible to make the most of a spread of property tax aid packages.

[ad_2]

Supply hyperlink